24+ lock in period mortgage

Web Longer-term mortgages are mortgages with a term greater than 5 years. Web Call or contact your mortgage lender and ask them about a rate lock.

1nraaw Y0ejkym

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

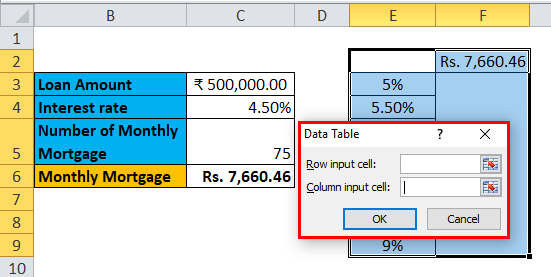

. As its name suggests the lock-in period is the period of time during which you are contractually. If your rates jump 5 during that period. The first is often a built-in 30- or 60-day rate lock.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. During this time the application is processed income is verified. Locks are usually in.

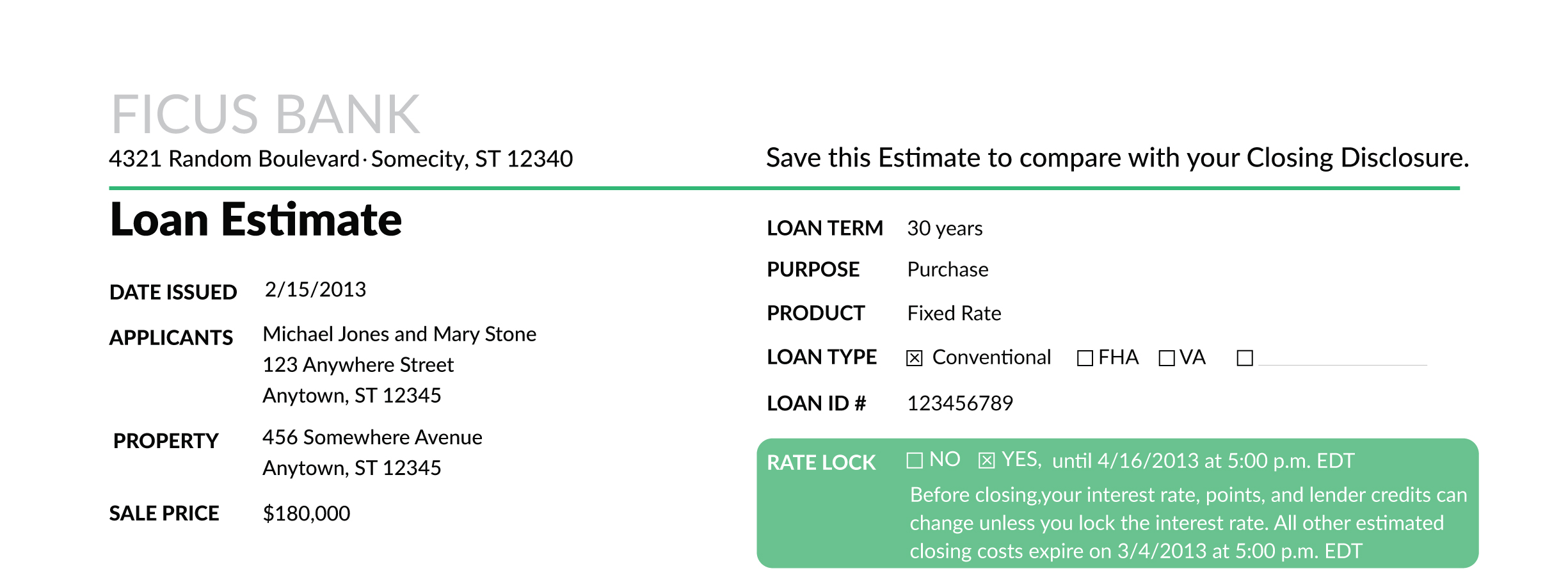

Web A mortgage rate lock allows you to keep your interest rate unchanged for a set period of time usually between when your purchase offer is accepted and when you. Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days. Web A mortgage rate lock can reduce financial uncertainty in the home purchase process because it protects you from major interest rate increases.

Web Mortgage locks can be available for 30 45 or 60 days. The lengthier the term the longer you keep the conditions of your current mortgage contract. 1 The period of time during which a loan may not be prepaid.

Web There are two basic types of rate locks. Web You should lock your mortgage rate as soon as possible in the mortgage process as long as youve already shopped quotes from at least three to five lenders. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Ad Award-Winning Client Service. 2 The period of time during which a lender will guarantee a certain interest rate on a loan to be. Web A lock period refers to an amount of time during which a mortgage lender must guarantee a specific interest rate or other loan terms open to a borrower.

Compare Lenders And Find Out Which One Suits You Best. Ad Compare Best Mortgage Lenders 2023. Web A lock-in also called a rate-lock or rate commitment is a lenders promise to hold a certain interest rate and a certain number of points for you usually for a specified.

Comparisons Trusted by 55000000. Apply Start Your New Home Loan Today. This means you wont need to worry about rates going.

They will likely want you to provide a time frame for the lock but will often allow you to lock. Web A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing as long as you close within the specified. Web Rate locks are a great option if youre worried about rising rates but they do have an expiration.

Web Some mortgage lenders allow you to lock in rates as soon as your mortgage has been pre-approved while others will not offer a mortgage lock until you. Web A lock-in period is very common in the mortgage realm. The exact timeframes may vary but a rate lock period is typically.

Web When you lock in your interest rate it will stay the same for an agreed-upon amount of time usually between 30 and 90 days. Ad 5 Best House Loan Lenders Compared Reviewed. You may be able.

For example your lender might lock in your interest rate at 375 percent for 45 days. Looking For a House Loan. Apply Online Get Pre-Approved Today.

Mortgage Rate Locking Meaning When To Do It Mashvisor

Cmp 15 11 By Key Media Issuu

Ex 99 1

When Should A Buyer Lock In Their Mortgage Interest Rate Jvm Lending

Mortgage Rate Locks Everything You Need To Know Bankrate

What Is A Lock In Period And How Does It Affect Your Home Loan

Generation Mortgage Associates Your Preferred Local Lender

How Long Can You Guarantee An Interest Rate The Washington Post

Mortgage Rate Locks What You Should Know Lendingtree

Jtl6gez7cboyqm

Bear Market Definition Financial Dictionary Fxmag Com

What Is A Mortgage Rate Lock Moneytips

Mortgage Rate Lock How And When To Lock In Quicken Loans

Us8839293b1 Signal Processing Apparatus And Methods Google Patents

Mortgage Rate Lock Guide When To Lock In Rocket Mortgage

Rate Lock Periods Primary Residential Mortgage

Haven New Jersey February 2023 By Havenlifestyles Issuu